Business Insurance in and around Newark

Calling all small business owners of Newark!

This small business insurance is not risky

Coverage With State Farm Can Help Your Small Business.

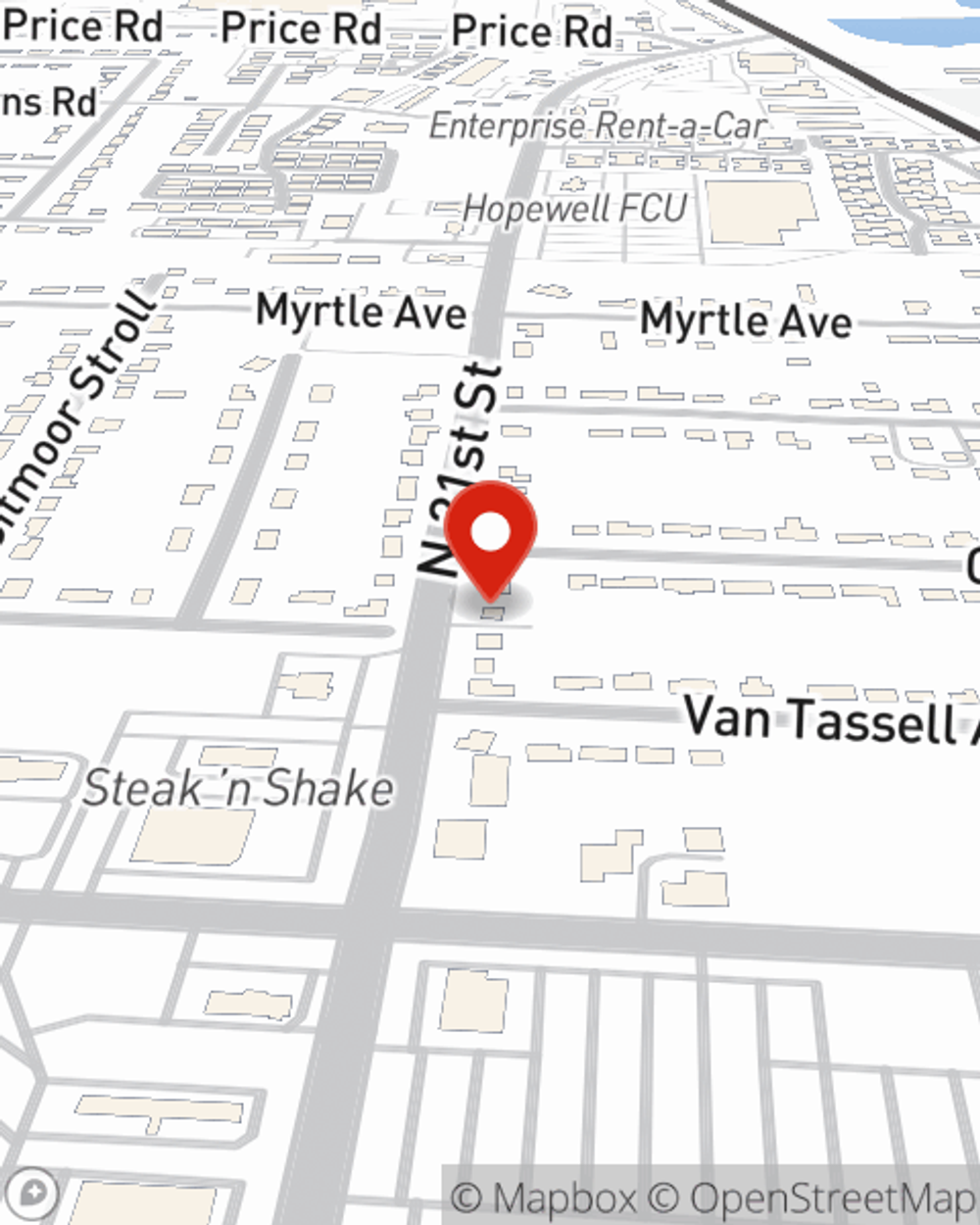

You may be feeling overwhelmed with running your small business and that you have to handle it all alone. State Farm agent Erin Curtis, a fellow business owner, understands the responsibility on your shoulders and is here to help you put together a policy that's right for your needs.

Calling all small business owners of Newark!

This small business insurance is not risky

Get Down To Business With State Farm

Did you know that State Farm has been helping small businesses grow since 1935? Business owners like you have turned to State Farm for coverage from countless industries. It doesn't matter if you are an optician or a surveyor or you own an advertising agency or a music school. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Erin Curtis. Erin Curtis is the person who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to learn more about your small business insurance options

At State Farm agent Erin Curtis's office, it's our business to help insure yours. Call or email our wonderful team to get started today!

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Erin Curtis

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.